Staged Reduction of the Company Tax Rate

The government has announced a staged reduction of the company tax rate beginning in the 2017-18 income year.

This change also involves a progressive increase to the annual aggregated turnover threshold for access to the 27.5% company tax rate, meaning that smaller companies will qualify earlier for the rate cut.

From the 2024-25 income year, there will be a further reduction each year for all companies until the corporate tax rate reaches 25% in the 2026-27 income year.

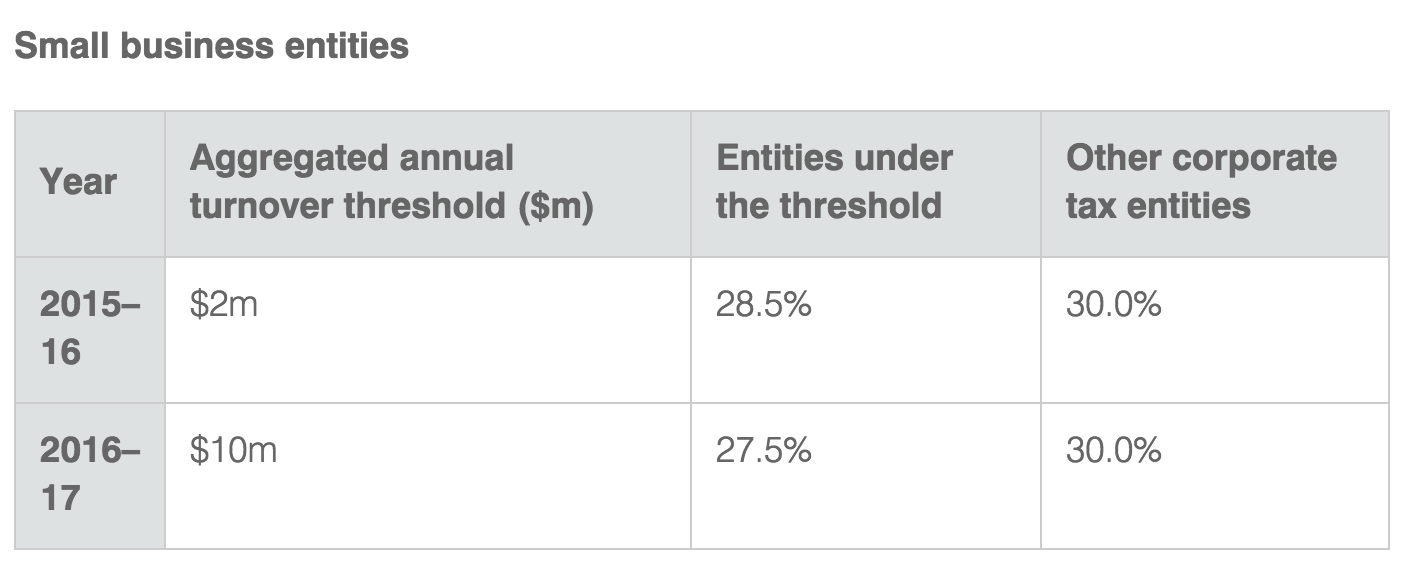

From 1 July 2016, the tax rate for businesses with an annual aggregated turnover of less than $10m will be 27.5%. Each year the turnover threshold will be increased to allow more companies to access the lower corporate tax rate as follows:

Source: (https://www.ato.gov.au/General/New-legislation/In-detail/Direct-taxes/Income-tax-for-businesses/Reducing-the-corporate-tax-rate/)