Australians lead a long healthy productive life BUT……this can lead to one of your greatest risks.

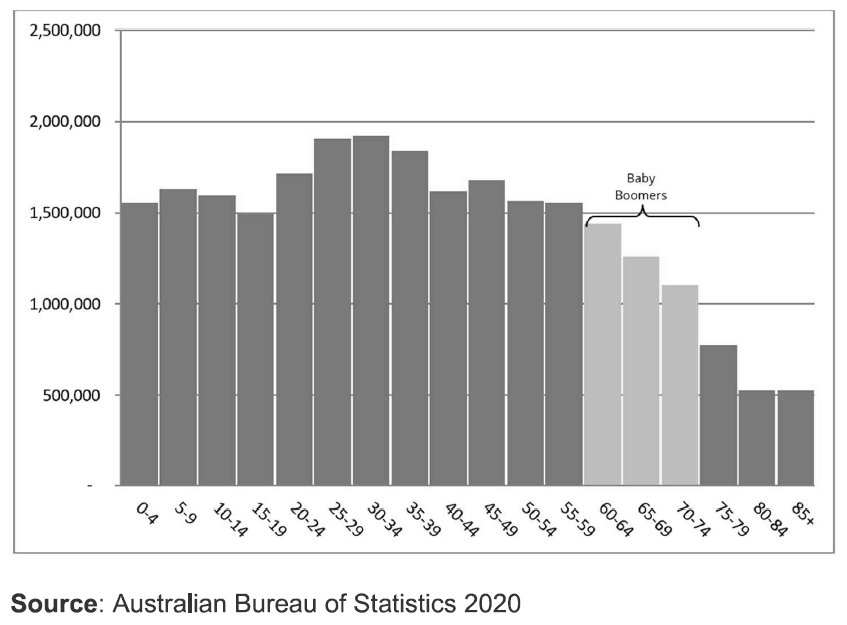

As of 2019 the Australian life expectancy was 80.9 for males and 85.0 for females which demonstrates a narrowing of the gap between the life expectancy of men and women. Yet a higher 59% of women are worried about outliving their savings compared with 47% of men, and 67% of divorced women represent the most worried. Outliving our money is an increased risk especially now with all-time low interest rates more so if that is how you are invested.

Looking after your financial choices and making the most of each option you have should be carefully considered and utilised. Just putting your money in the bank and forgetting about it is not an option.

Planning how to invest your money requires assistance, experience, and planning. In this current all-time low interest rate environment and period of longer life expectancy, investment must contain a portion of capital growth. Capital growth can come from property, shares, international shares, and businesses.

Conservative investment with high exposure to term deposits and cash carries a much higher risk than one might think. It in fact would not be as conservative as other options which the following example can demonstrate.

Years ago, a new client in her early seventies wanted advice on her maturing term deposits and fixed interest debentures. The interest rates believe it or not at the time were invested at an annual rate of between 10% to 13%! The new interest rate on offer when the term/s expired were about 6% which was a shock to her. Because this client had most of her funds invested for interest earnings and no growth, we had to plan for the expiry of her remaining various term deposits and debentures to smooth out her income, prepare for the drop in the new interest rates and provide for capital growth going forward. After quite a bit of extensive explanation and discussion she saw the dilemma. Fortunately, several of her term deposits and debentures were spread over a couple of years so we had time to adjust the strategy. Alteration to her investment strategy resulted in capital growth investments which had tax efficient income from dividends, tax deferred income from property investment, tax beneficial income from superannuation and a combination of every couple of years extracting a bit of capital growth from her growth investments. The result was that we were able to closely maintain the level of income and cash flow she needed, save her a lot of stress, and worry and provide an increase to her wealth.

If you know someone who is complaining or struggling with interest rate earnings suggest they speak with us.