TEMPORARY REDUCTION TO MINIMUM ANNUAL SUPERANNUATION PENSION PAYMENTS

As a result of the coronavirus (COVID-19) crisis, the Government has reduced the minimum annual pension drawings one is required to take from superannuation account-based pensions, annuities and term allocated pensions. This is intended to help retirees manage the impact of volatile financial markets on their retirement savings.

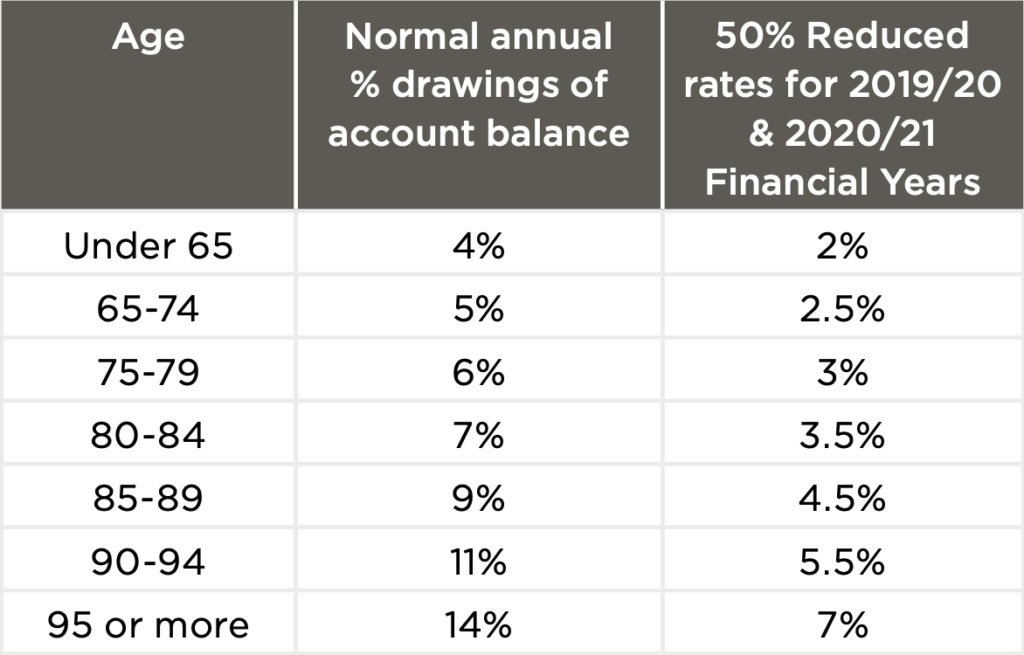

Minimum annual income amounts for Account Based Pensions

The minimum income amount for account-based pensions has been reduced by 50% for both the previous financial year 2019-2020 and the current 2020-2021 financial year. Below are the previous and new minimum pension levels for different age groups:

From 1 July 2020, the 50% reduction will automatically be applied for those who have elected to receive the minimum pension payments from their Account Based Pension. This can be altered however back up to the normal annual percentage drawings at your request.

For those with Term Allocated Pensions, your annual payment will be calculated as normal on 1 July 2020. However, you can elect to receive a lower pension of up to 50% of this annual pension amount for the 2020-2021 financial year at your request. Ideally the recent restrictions have resulted in living expenditure being reduced and thus allowing retirees room to move in their revised budget to consider taking advantage of the new pension minimums. This will allow superannuation pension portfolios to ride out this period of extreme market volatility and not be forced to sell assets in a falling market simply to comply with the usual minimum drawdown amounts.

By preserving more capital, you will have more money working for you to capture the market upswing when it inevitably and eventually occurs.

Please contact our office should you wish to discuss or amend your pension drawing levels.

Source: The Australian Taxation Office in conjunction with The Federal Government