PENSION CHANGES FROM 1ST JULY 2023

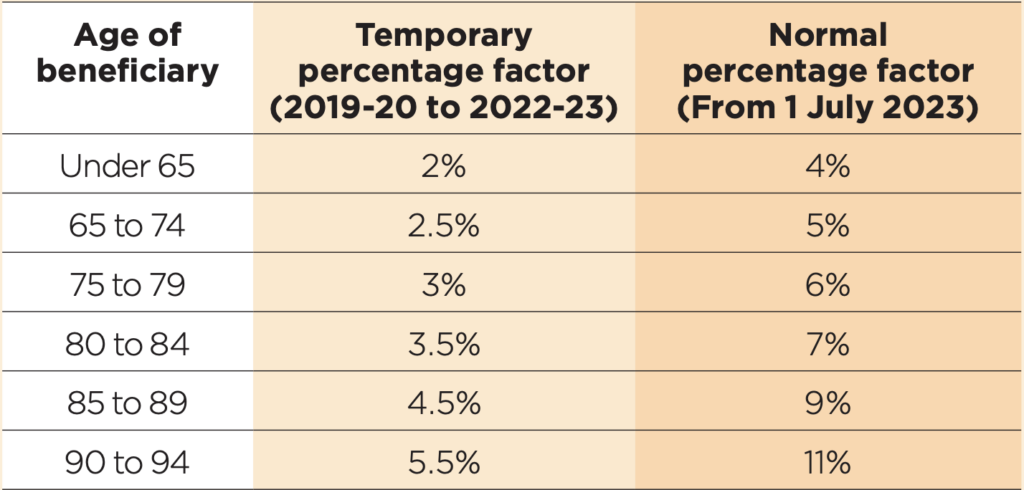

The following changes are being implemented for all Account Based Pensions. The minimum percentage is being increased back to original levels from pre covid.

What does this mean for you?

Your Account based Pension with a retail or wholesale platform will implement the change automatically, if you are currently on the set minimum pension or a specific amount which is below the new minimum levels from 1 July 2023.

Do I need an Account Based Pension?

If you have fully retired or are considering full retirement and you are over the age of 60, met your preservation age, or met a condition of release you have the option of converting your superannuation fund into an account-based pension and commencing an income stream.

The advantages of this are that you will be moving funds into a taxfree fund. The earnings on investments are tax free as well as your pension income withdrawals are tax free. This is the most common reason people start an income stream. Investments held outside of pension are taxed according to your personal position.

You will also have the ability of commencing a flexible income stream that can be paid fortnightly, monthly, quarterly, half yearly or annually. Account based Pensions also allow lump sum withdrawals if required.

There is the option of retaining your super in accumulation phase as well as starting an account-based pension. Contributions to super can now be made up until age 75.

Planning for retirement and commencing an account-based pension is important and should be discussed before you retire with a Financial Adviser.

Please call our Financial Planning Team to discuss on 1300 655 096.