Elder Financial Abuse

Approximately 15% of Australia’s population is currently over 65 years of age, with this number expected to increase to more than double by 2050.

One of the biggest challenges of Australia’s rapidly changing population is the need to better protect the rights of older Australians and ensure they are free from all kinds of abuse, including the all too prevalent financial abuse. According to new research released by the Australian Institute of Family Studies (AIFS) “Almost one in six (14.8%) older Australians report that they have experienced abuse in the past 12 months, and only about one-third of those victims have sought help.”

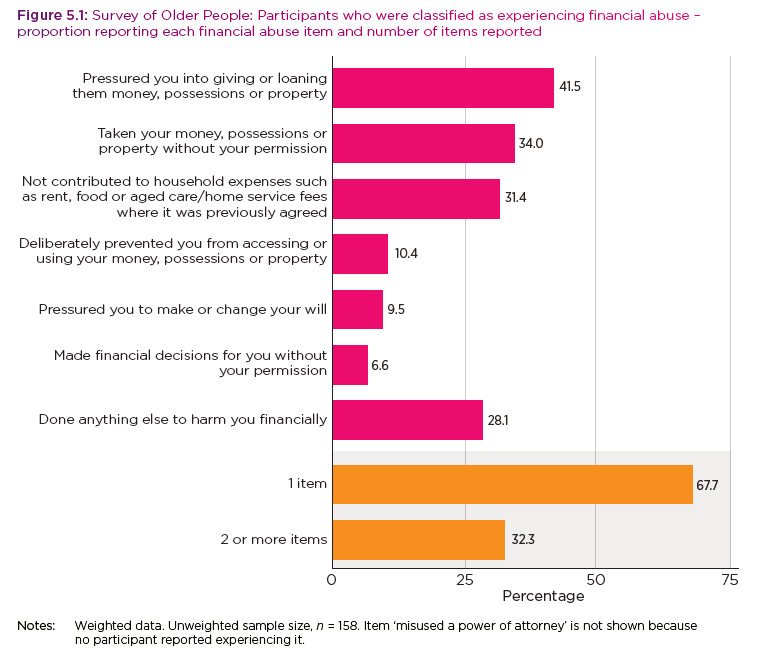

AIFS Types of financial abuse reported

From a financial abuse standpoint, AIFS reported that inheritance impatience was the most common form of abuse.

The Council of Attorneys-General’s defines financial abuse as:

…the misuse or theft of an older person’s money or assets. It can include but is not limited to, behaviours such as using finances without permission, using a legal document such as an enduring power of attorney for purposes outside what it was originally signed for, withholding care for financial gain, or selling or transferring property against a person’s wishes.

(Council of Attorneys-General 2019)

We are here to assist if you feel you or loved one have been a victim of financial abuse, in any shape or form, and urge you to please speak with us confidentially and independently.