CONTRACTORS V EMPLOYEES

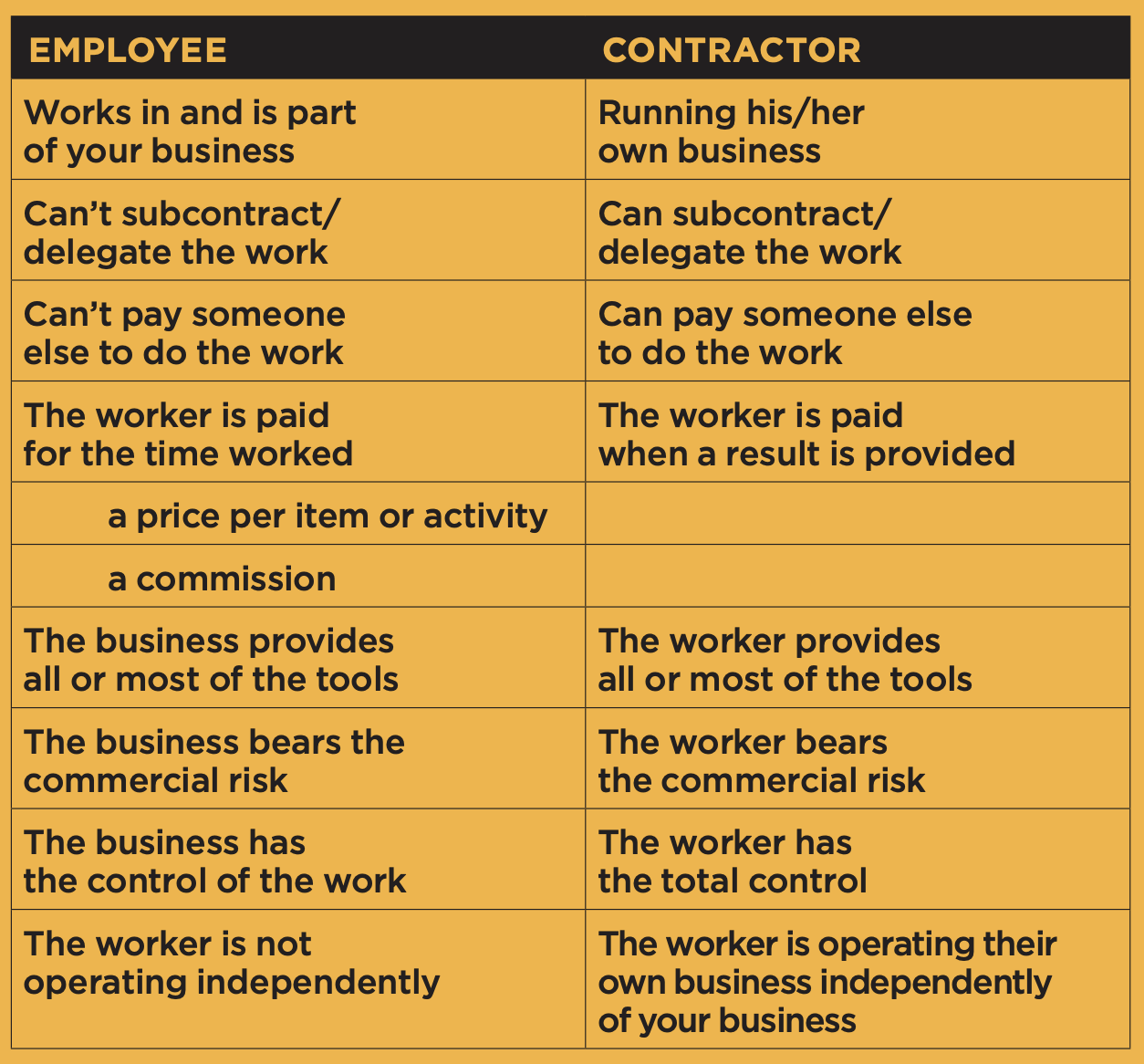

If you are a contractor, make sure you are meeting the ATO’s requirements around being a contractor, as opposed to an employee, you need to know the difference between an employee and a contractor.

YOUR TAX & SUPER OBLIGATIONS

Your tax, super and other obligations will vary depending on whether your worker is an employee or contractor.

If your worker is an employee, you’ll need to:

- withhold tax from their wages, report and pay the withheld amounts to the ATO

- pay super, at least quarterly, for eligible employees

- Report and pay fringe benefi ts tax (FBT) if you provide your employee with fringe benefits

If your worker is a contractor:

- they generally look after their own tax obligations, so you don’t have to withhold tax from payments to them unless they don’t quote their ABN to you, or you have a voluntary agreement with them to withhold tax from their payments

- you may still have to pay super for individual contractors if the contract is principally for their labour

- you don’t have FBT obligations

Any of the following types of workers are always treated as employees:

- apprentices

- trainees

- laborers

- Trades assistants Companies, trusts and partnerships are always contractors.