CEO Blog

Deborah Rognlien

Chief Executive Officer

of The Intelligent Financial Group

The business and services of The Intelligent Financial Group have continued to operate without interruption since the beginning of the COVID-19 situation.

The differences are that all appointments have been by phone or electronic. This is now to continue until further instructions and/or clarification from Government bodies.

Australia as a nation has been an excellent performer on the world stage in dealing with the COVID-19 situation. Australia has ranked as 96th in the world for a low number of COVID-19 cases. This has contributed to the increase in business confidence and spending on capital items. The increase in consumer confidence has resulted in an increase of 7.9% in spending on goods and services which ended the recession. Josh Frydenberg our Federal Treasurer announced, “Technically the Recession is over, but the Recovery is not.”

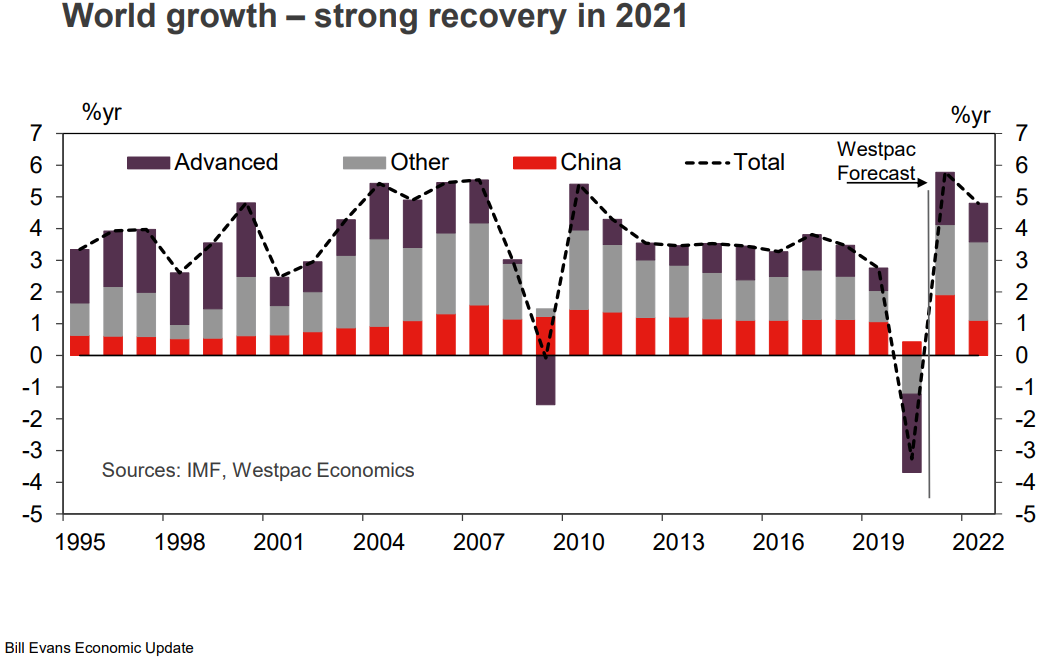

Economic growth for 2021 is estimated to be 4-5% due to Australia doing a better job than other countries in tackling COVID-19 and our government stimulus measures. An additional 1.5 billion government funding over four years has been allocated for a Modern Manufacturing Strategy to ensure Australia is competitive and resilient.

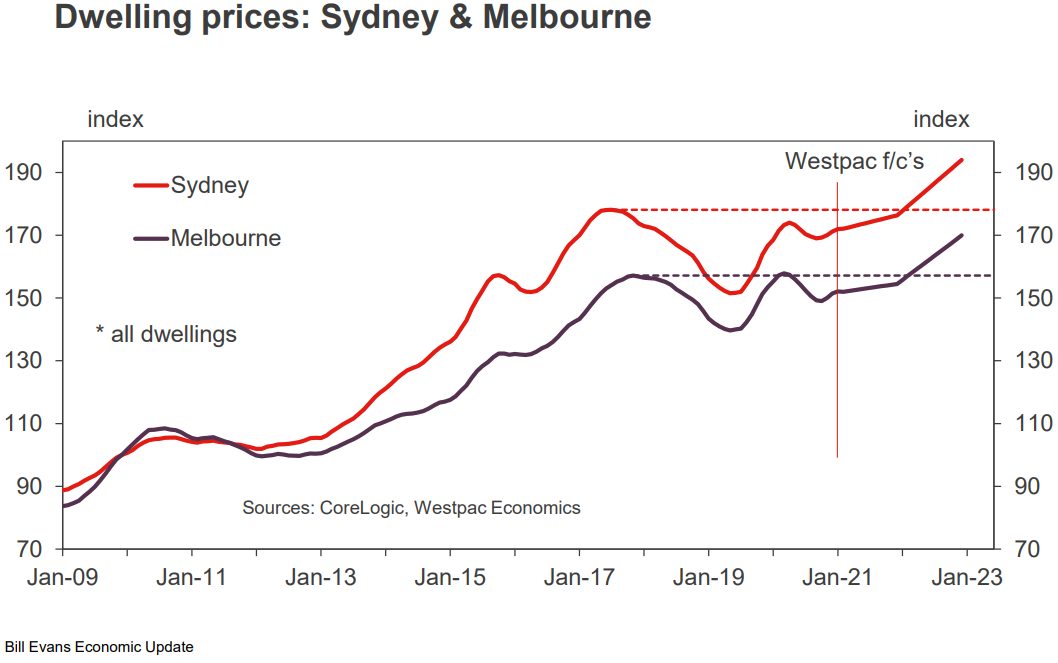

Residential Property is anticipated to perform well over the next two years due to reduced immigration levels and then level out. Shortages of housing will affect the further growth prospects dependant on immigration.

China continues to be our biggest trading partner in 2019/20 with 39% of all exports to China and 27% of imported goods from China. Iron ore exports represent 56% of all Australian goods exported to China with LNG and Gold continuing to be significant exports to China.

Australia’s future and growth are to be focused on good businesses post job keeper and particularly investment in Energy, Medicals, Services, Digital Broadband, IT, Infrastructure and Water Infrastructure.

We all need to turn down the noise from the overload of information and social media coming into our heads and focus on a chosen investment strategy which takes into perspective the cyclical nature of investments.

Let us help you plan your Financial Goals and Investment Strategy.