Medicare Levy and Medicare Levy Surcharge

What’s the difference?

Income for surcharge purposes includes the sum of taxpayer’s taxable income, reportable fringe benefits, reportable superannuation contributions, total net investment losses (financial investments and rental property) less any taxed component of a superannuation lump sum received.

The Medicare Levy is liable to be paid by an individual who is resident of Australia at any time during the income year at the rate of 2% of his/her taxable income for the year.

The Medicare Levy Surcharge applies to individual taxpayers on higher incomes who do not have adequate private patient hospital insurance for themselves and their dependants – that is, a policy that provides benefits in relation to fees and charges for hospital treatment.

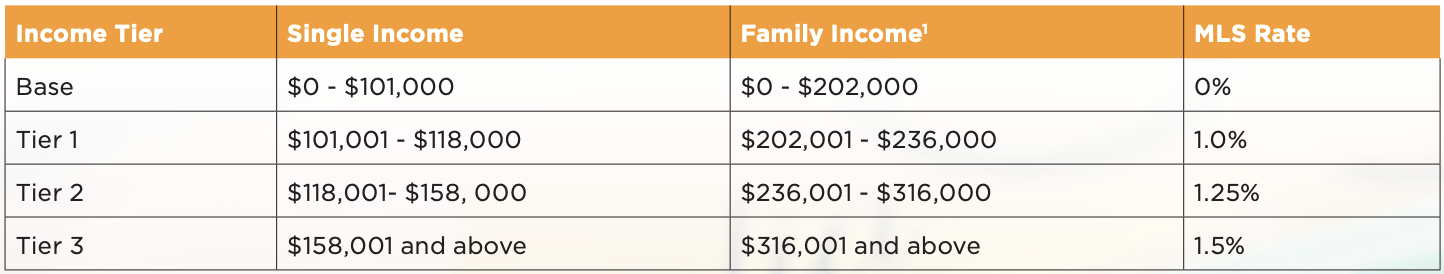

As such, they may be liable for a Medicare Levy Surcharge in addition to the Medicare levy. The rate at which the Medicare Levy Surcharge is applied is determined under a tiered income system whereby a taxpayer’s level of ‘income for surcharge purposes’ is classified as either ‘Base Tier’, ‘Tier 1’, ‘Tier 2’ or ‘Tier 3’. Each tier has a range of income applied to it and higher thresholds apply where dependants are involved.

The calculation of either levy is also dependent upon whether the taxpayer is single with no dependants, a single person with dependants, or a couple with or without dependants. In the case of a couple, their combined income is taken into account, and the family thresholds apply.

For further information, please contact our office.