Are you so interested in the potential increase in the value of your home or the fluctuating value of your shares that you are forgetting about ‘how best to put food on the table’ from good long term income producing dividends?

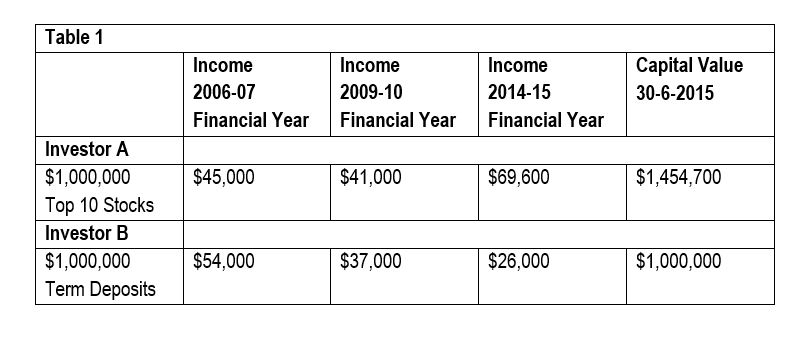

A serious medium to long term investor striving to become financially independent would prefer to rely on the income from dividends rather than the daily fluctuations in share prices. It is the regularity of the dividends, stability and growth of income that becomes most important. This is the protection against inflation and the weapon to fight against the increased cost of living. In the financial year just after the Global Financial Crisis (GFC) the cash dividend yield of Australia’s 10 largest companies was 4.1% in 2009/2010. In the 2014/2015 financial year these same companies produced a cash dividend yield of 6.96%. This was an increase of dividend yield of 52.34%.

As a result of the GFC the share market investor only saw their income decline 8.9% from 4.5% to 4.1% BUT the term deposit investor saw their income decline from 5.4% to 3.7% which is a drop in income of 31.48%. It now only gets worse for the term deposit investor with a drop in rates down to 2.6%. Please see the table 1 below to demonstrate the benefits of a good diversified medium to long term investment strategy when comparing this with fixed interest and term deposits. Term deposits and fixed interest DO have risk!